All Categories

Featured

Table of Contents

- – Who provides the best Level Term Life Insuranc...

- – What is the best Level Term Life Insurance For...

- – How does Level Term Life Insurance Premiums w...

- – What types of Level Term Life Insurance For ...

- – Is there a budget-friendly Level Term Life I...

- – What does a basic Level Term Life Insurance ...

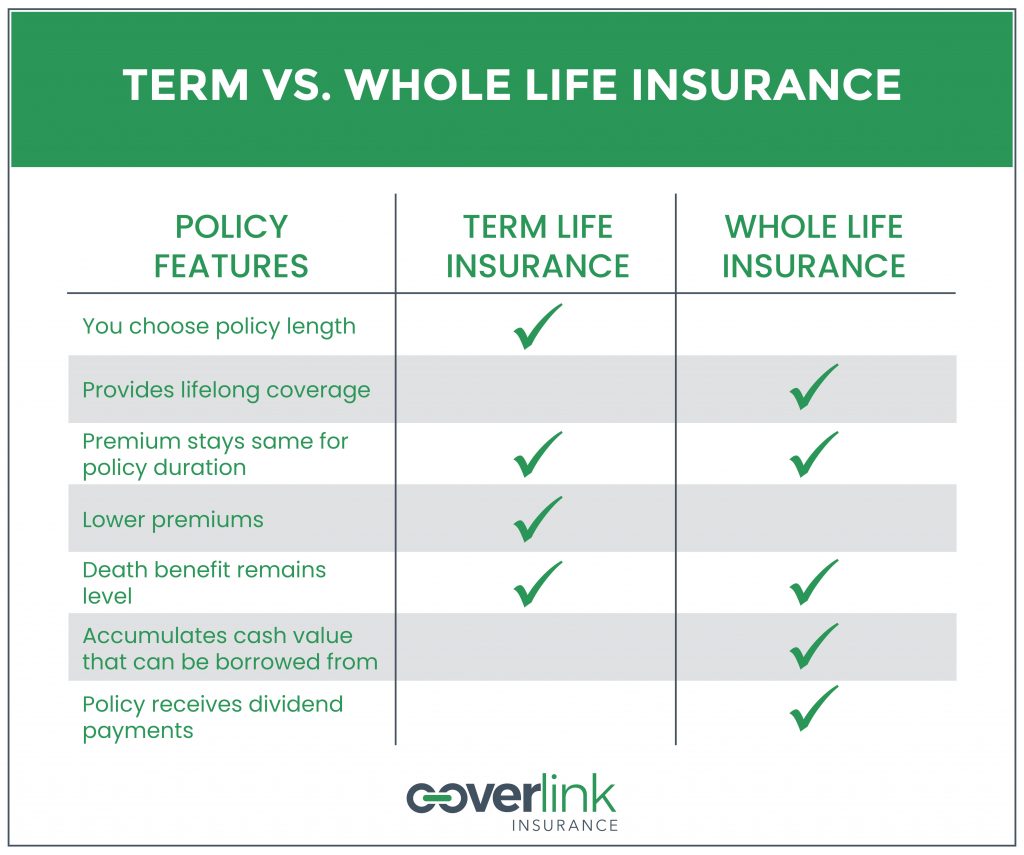

The main differences in between a term life insurance coverage plan and an irreversible insurance plan (such as entire life or global life insurance policy) are the period of the policy, the build-up of a money worth, and the price. The appropriate choice for you will certainly rely on your requirements. Here are some points to take into consideration.

People that own whole life insurance coverage pay much more in premiums for much less coverage but have the protection of understanding they are protected forever. Level term life insurance vs whole life. Individuals who get term life pay premiums for an extended duration, yet they obtain absolutely nothing in return unless they have the bad luck to die before the term runs out

Additionally, considerable administrative costs often cut right into the rate of return. This is the source of the phrase, "purchase term and spend the difference." The performance of irreversible insurance can be steady and it is tax-advantaged, giving additional advantages when the stock market is volatile. There is no one-size-fits-all response to the term versus long-term insurance coverage argument.

The biker assures the right to convert an in-force term policyor one ready to expireto a long-term plan without experiencing underwriting or confirming insurability. The conversion rider need to allow you to convert to any kind of permanent policy the insurer provides with no constraints. The key features of the biker are keeping the initial wellness ranking of the term plan upon conversion (also if you later have wellness problems or become uninsurable) and making a decision when and exactly how much of the insurance coverage to transform.

Who provides the best Level Term Life Insurance Vs Whole Life?

Naturally, general premiums will certainly enhance substantially since entire life insurance policy is extra costly than term life insurance. The benefit is the assured approval without a medical exam. Clinical conditions that create during the term life duration can not create costs to be increased. The company might need limited or complete underwriting if you desire to add added bikers to the new plan, such as a long-term care cyclist.

Whole life insurance comes with significantly higher month-to-month premiums. It is suggested to give insurance coverage for as lengthy as you live.

It relies on their age. Insurer established a maximum age restriction for term life insurance policy plans. This is usually 80 to 90 years of ages, yet might be greater or reduced relying on the business. The premium also climbs with age, so an individual aged 60 or 70 will certainly pay substantially even more than somebody decades younger.

Term life is somewhat comparable to cars and truck insurance. It's statistically not likely that you'll require it, and the costs are money down the drain if you don't. If the worst occurs, your family will get the advantages.

What is the best Level Term Life Insurance For Families option?

___ Aon Insurance Coverage Providers is the brand name for the brokerage firm and program administration operations of Fondness Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Providers Inc.; in CA, Aon Fondness Insurance Coverage Providers, Inc.

The Strategy Agent of the AICPA Insurance Depend On, Aon Insurance Providers, is not affiliated with Prudential. Team Insurance policy coverage is issued by The Prudential Insurance Policy Company of America, a Prudential Financial company, Newark, NJ.

For the many part, there are 2 sorts of life insurance policy plans - either term or permanent plans or some combination of both. Life insurance providers provide various types of term plans and standard life plans in addition to "interest sensitive" items which have become much more widespread considering that the 1980's.

Term insurance coverage offers security for a specified amount of time - What is level term life insurance?. This duration could be as short as one year or supply coverage for a particular variety of years such as 5, 10, two decades or to a specified age such as 80 or in some cases as much as the oldest age in the life insurance policy mortality tables

How does Level Term Life Insurance Premiums work?

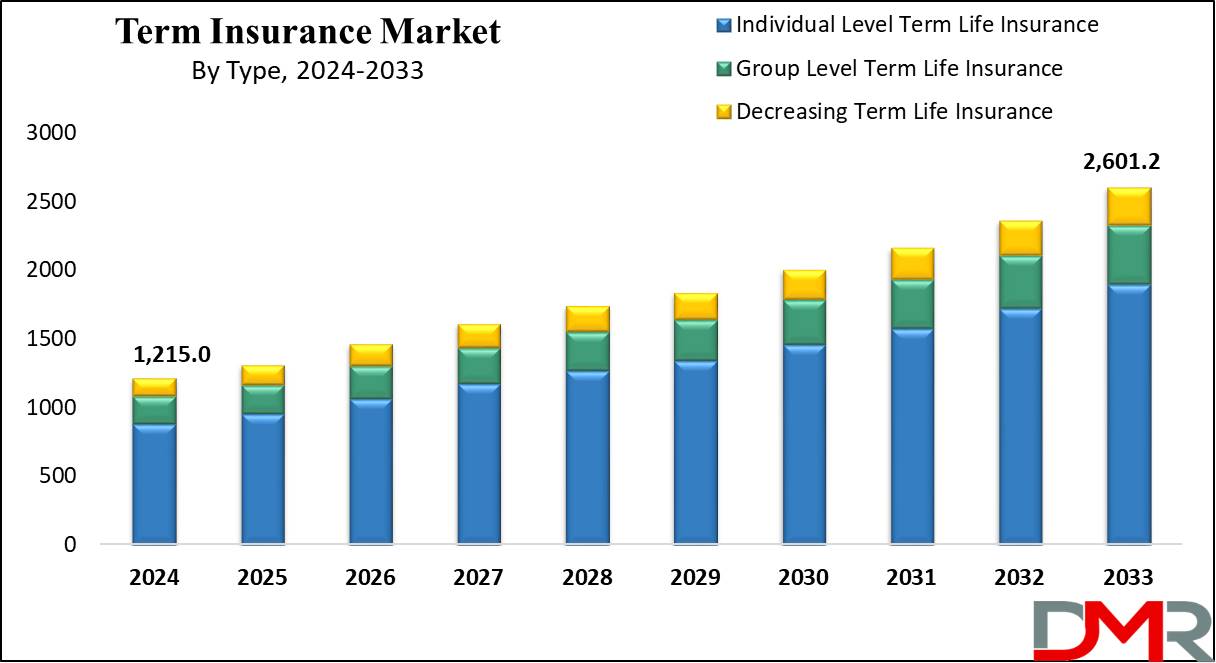

Currently term insurance policy rates are really competitive and among the cheapest traditionally seasoned. It needs to be kept in mind that it is an extensively held idea that term insurance coverage is the least pricey pure life insurance coverage available. One needs to assess the plan terms carefully to make a decision which term life options appropriate to fulfill your particular situations.

With each brand-new term the costs is raised. The right to restore the plan without evidence of insurability is an important benefit to you. Otherwise, the danger you take is that your wellness may wear away and you might be unable to acquire a policy at the very same rates and even at all, leaving you and your beneficiaries without protection.

You must exercise this option during the conversion period. The length of the conversion duration will certainly vary depending on the sort of term plan bought. If you convert within the prescribed duration, you are not required to offer any type of info regarding your wellness. The costs rate you pay on conversion is typically based on your "present acquired age", which is your age on the conversion date.

What types of Level Term Life Insurance For Seniors are available?

Under a degree term policy the face quantity of the plan stays the very same for the whole period. Frequently such plans are sold as mortgage defense with the amount of insurance coverage lowering as the balance of the mortgage reduces.

Commonly, insurance companies have not had the right to change premiums after the policy is marketed. Considering that such policies may continue for years, insurers must make use of conventional death, rate of interest and expense price quotes in the costs calculation. Flexible costs insurance coverage, nonetheless, enables insurance providers to supply insurance coverage at reduced "present" premiums based upon less conventional presumptions with the right to change these costs in the future.

While term insurance coverage is designed to supply defense for a specified time duration, irreversible insurance is created to offer insurance coverage for your entire life time. To maintain the premium rate level, the premium at the younger ages goes beyond the real price of security. This additional costs builds a reserve (money value) which aids pay for the policy in later years as the cost of security rises over the costs.

Is there a budget-friendly Level Term Life Insurance Policy option?

With level term insurance coverage, the cost of the insurance will stay the very same (or potentially reduce if rewards are paid) over the term of your plan, generally 10 or twenty years. Unlike irreversible life insurance policy, which never ever ends as long as you pay premiums, a level term life insurance coverage policy will certainly finish at some factor in the future, typically at the end of the period of your degree term.

Due to this, many individuals use long-term insurance as a secure monetary preparation device that can offer many needs. You may be able to transform some, or all, of your term insurance coverage throughout a set period, normally the first one decade of your policy, without requiring to re-qualify for coverage also if your health has transformed.

What does a basic Level Term Life Insurance Benefits plan include?

As it does, you might want to include to your insurance coverage in the future. As this takes place, you may desire to ultimately reduce your death advantage or take into consideration converting your term insurance policy to an irreversible policy.

Long as you pay your costs, you can rest very easy recognizing that your loved ones will certainly get a fatality advantage if you die throughout the term. Lots of term policies enable you the capacity to convert to permanent insurance policy without having to take an additional wellness test. This can permit you to make the most of the fringe benefits of an irreversible plan.

Table of Contents

- – Who provides the best Level Term Life Insuranc...

- – What is the best Level Term Life Insurance For...

- – How does Level Term Life Insurance Premiums w...

- – What types of Level Term Life Insurance For ...

- – Is there a budget-friendly Level Term Life I...

- – What does a basic Level Term Life Insurance ...

Latest Posts

What Is Final Expense Insurance Policy

Life Insurance Burial

Instant Insurance Life Quote Whole

More

Latest Posts

What Is Final Expense Insurance Policy

Life Insurance Burial

Instant Insurance Life Quote Whole